For the second time this quarter, the crypto market is under severe pressure as global risk sentiment collapses. What began as a routine correction quickly escalated into a full-scale market unravelling, dragging Bitcoin, Ethereum, and a wide range of altcoins into deep red territory. Across major exchanges and analytics dashboards, the mood has shifted from cautious optimism to outright fear.

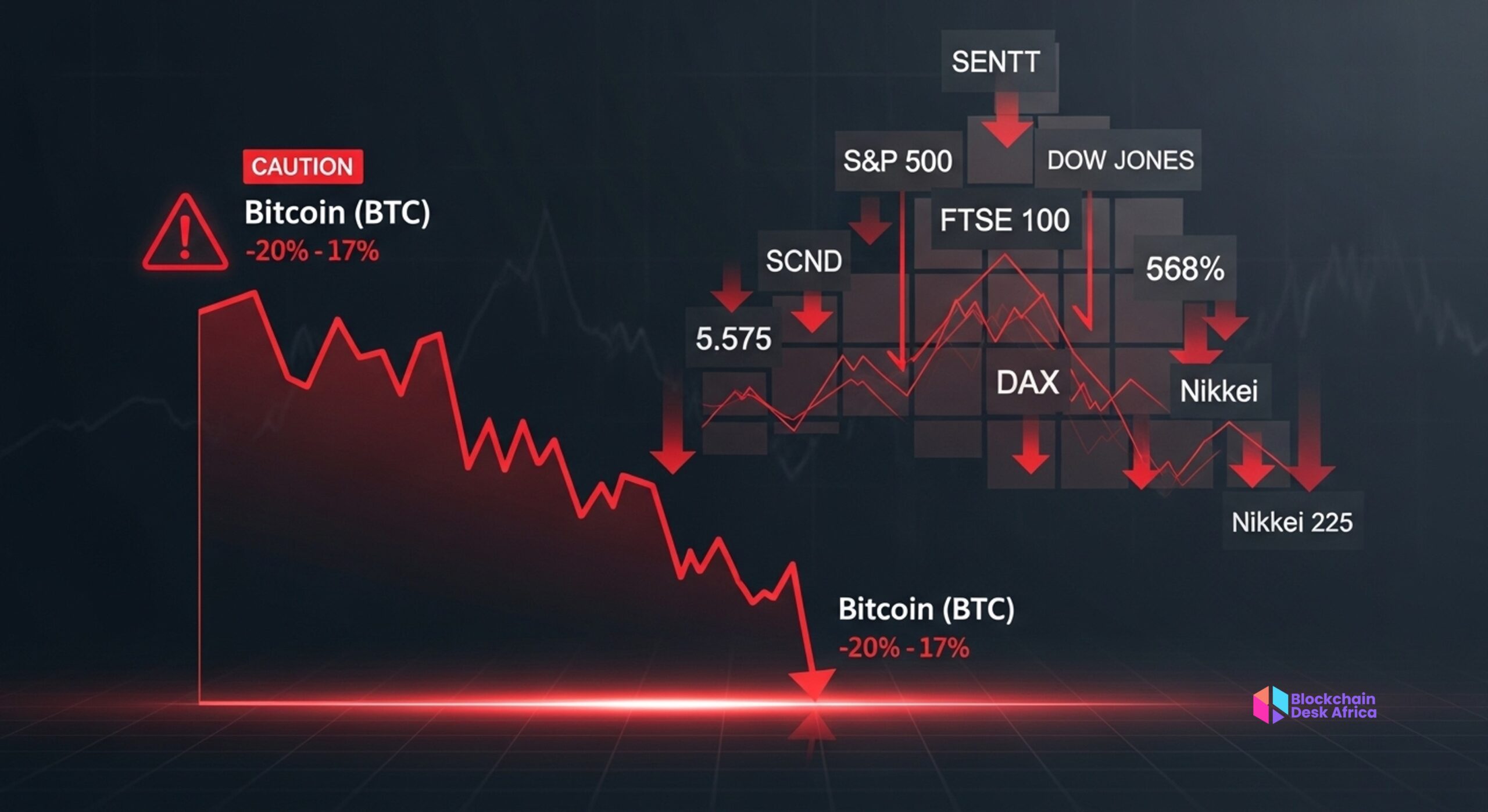

This downturn is not happening in isolation. The broader financial markets are experiencing their own tremors. Volatility in the S&P 500, rising global bond yields, and renewed doubts about central bank policy have all contributed to a powerful “risk-off” wave—one that has hit cryptocurrencies harder than most asset classes. The correlation between Bitcoin and traditional equity indices, which many believed was weakening, snapped back into focus as both markets dipped in tandem.

Over the past 48 hours, the cryptocurrency ecosystem has been swept up in a liquidity squeeze intensified by macroeconomic pressure, leveraged liquidations, and investor panic. The market isn’t merely cooling; it is reacting to global financial stresseal time. Time.

A Look at What’s Driving the Meltdown

The immediate trigger behind the sell-off is growing pessimism in global markets. Fresh economic data from the United States fueled concerns that the Federal Reserve may not deliver aggressive rate cuts as quickly as investors hoped. Each hint of tighter monetary conditions pushes capital away from high-volatility assets, and crypto remains one of the first casualties when sentiment weakens.

At the same time, a stronger U.S. dollar and rising bond yields are tightening liquidity worldwide. Financial analysts have been warning for weeks that global markets were approaching a “risk reset,” and this week delivered exactly that. As liquidity thins, leveraged traders become vulnerable. Once Bitcoin broke key support levels, a chain reaction of liquidations followed. On some exchanges, hundreds of millions in long positions were wiped out in hours, amplifying downward pressure.

Adding further stress, trading volumes have fallen sharply. In sluggish markets, every sell-off hits harder. With fewer buy orders to cushion declines, Bitcoin slid to fresh multi-month lows, with Ethereum and altcoins suffering even deeper losses. The downturn has been fierce enough that even seasoned traders describe the current environment as “emotionally driven, technically fragile, and macro-dominated.”

Sentiment Turns Cold as Investors Retreat

One of the clearest signs of market fear is the behaviour of short-term holders. On-chain indicators show significant selling from wallets that typically hold for weeks, not years. This suggests panic rather than strategy. The crypto fear index has swung into extreme territory, reflecting a growing belief that the decline may not be over.

Major institutional players are also reducing exposure. Outflows from Bitcoin-related investment products have intensified, mirroring the retreat happening in equity index funds. The narrative that “crypto moves independently of traditional markets” is being tested again, and this time, global financial stress is leaving no room for decoupling.

Even infrastructure setbacks have added weight to the downturn. The recent Cloudflare outage, which briefly disrupted the front ends of explorers and DeFi dashboards, reminded investors how fragile Web3’s Web2 dependencies still are. Although unrelated to price movement, the timing contributed to an already fragile psychological climate.

Altcoins Absorb the Hardest Blow

While Bitcoin and Ethereum dominate global headlines, the sharpest losses are happening across mid-cap and low-cap tokens. Liquidity pools have thinned, on-chain volume has slowed, and several networks are seeing weakened activity as traders exit to preserve capital. For projects without strong fundamentals, the sell-off has been brutal.

DeFi protocols have also seen significant dips in total value locked. The combination of falling token prices, reduced lending activity, and declining stablecoin liquidity has tightened conditions across the entire ecosystem.

Where the Market Stands Now

Crypto markets are entering a phase where fundamentals matter less than macro forces. The dominant driver is fear, fear of tighter monetary policy, fear of liquidity shocks, and fear that the global economy may be entering a more volatile period.

For traders, the environment calls for caution and discipline. For builders, it highlights the need for resilient systems that can withstand macro-driven turbulence. And for long-term investors, it may represent a moment to observe rather than react.

The turbulence is not unprecedented, but it is significant. As long as global markets remain under pressure, cryptocurrencies will continue to feel the weight. The coming days will determine whether this downturn stabilises or whether market volatility deepens before a recovery sets in.