Introduction

For decades, real estate and agriculture have been regarded as stable, wealth-building investments. Yet in Africa, these asset classes remain gated by wealth, bureaucracy, and steep entry costs. Ordinary citizens rarely get access to prime commercial property, fertile farmland, or mixed-use developments. Minimums are high, paperwork is daunting, and opportunities are usually reserved for elites.

But what if this barrier could be broken down? What if instead of needing thousands of dollars and years of savings, people could buy fractions of valuable assets through blockchain tokens, transparent, tradable, and with smaller minimums? That’s the promise of real-world asset (RWA) tokenization: turning tangible investments like land or property into digital shares anyone can own.

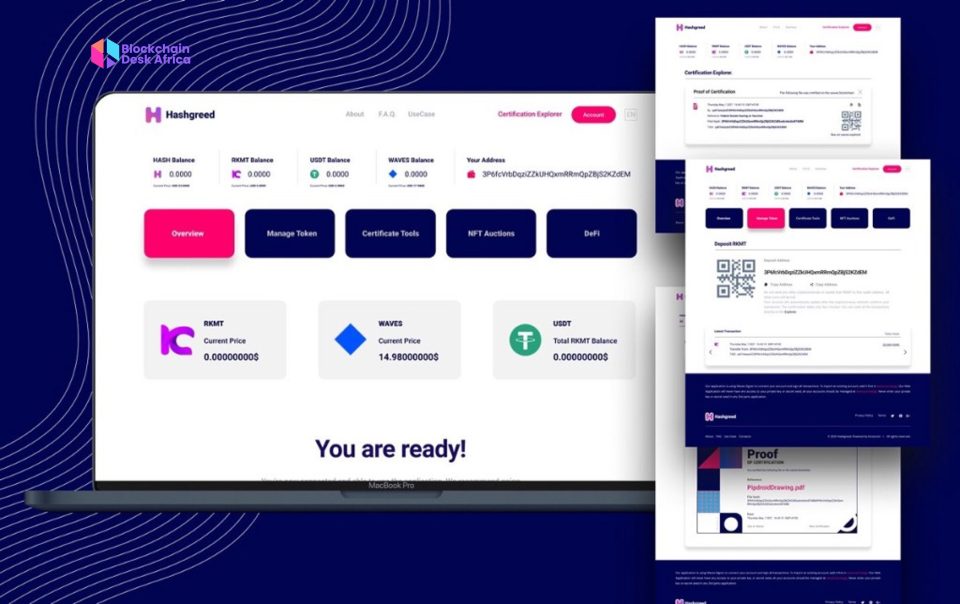

Hashgreed is positioning itself at the forefront of this. Billed as Africa’s first platform for tokenizing real-world assets and creating NFT markets around them, it aims to make farmland, real estate, and commercial ventures accessible to everyday investors. With regulated infrastructure, compliance-first tools, and a focus on practicality over speculation, Hashgreed is attempting to rewrite who gets to participate in wealth creation across the continent.

What is Hashgreed?

Hashgreed is a platform that converts real world assets into digital tokens,real estate, agricultural farms, recreational sites, etc, allowing investors to buy into them fractionally. It also has a marketplace, where these digital asset securities and NFTs derived from these assets can be traded.

They work with real estate developers, owners, and projects to structure SPVs (special purpose vehicles) and tokenized offerings (e.g. farmland, smart city residential / commercial, mixed-use buildings). Then, those tokens are offered to individuals, institutions, or governments.

Background Story

Hashgreed was conceived as a response to two key market realities: the difficulty of accessing real estate investment for average Africans and the inefficiencies in fundraising for developers and property owners. On one side, you had individuals locked out of wealth-building opportunities; on the other, developers and landowners struggling to raise capital through traditional banks or investors.

Bridging these pain points with blockchain tokenization, Hashgreed sought to create a marketplace where both sides win. Developers raise funds by fractionalizing ownership of their projects, while investors gain affordable, verifiable stakes in high-value assets.

Features

1. Fractional Ownership of Assets

Hashgreed’s offering is tokenization: breaking down expensive assets like luxury apartments or farmland into digital tokens. Instead of needing millions to buy an entire building, investors can contribute smaller amounts and own a share of the project.

2. Low Minimum Entry

Many offerings on Hashgreed are structured with minimum investments as low as ₦1,000 (a few U.S. dollars). That’s a sharp departure from traditional property markets where minimums lock out all but the wealthy.

3. Diverse Asset Classes

Hashgreed’s marketplace spans multiple sectors:

- Residential and Commercial Real Estate – e.g., GW Towers in Eko Atlantic City.

- Agricultural Projects – e.g., Vinekross Farms.

- Recreational and Mixed-Use Developments – e.g., FunCity FEC Alaro.

- Smart Cities and Innovation Hubs – infrastructure-heavy projects offering long-term value.

4. NFT Marketplace and Digital Securities

Some offerings take the form of digital securities, others use NFTs tied to ownership rights. This hybrid model blends Web2 regulatory frameworks with Web3 digital flexibility.

5. SPV Structures & Transparency

Each investment is structured via a Special Purpose Vehicle (SPV), ensuring that ownership rights and liabilities are clear. This model mirrors global best practices in real estate investment trusts (REITs).

6. Instant Redemption (Post-Offering)

Investors can redeem their tokens once an offering ends, with some designed for instant redemption. This shortens the traditionally long wait associated with property investments.

Use Cases

The true strength of Hashgreed lies in how these features apply in the real world. The platform is designed to unlock practical, wealth-building opportunities across sectors that have long been gated by high costs and exclusivity.

- Real Estate Tokenization – Property developers can fractionalize ownership of land, housing, or commercial buildings, lowering the barrier to entry for investors.

- Creative Web3 Commerce – Artists, musicians, and filmmakers can monetize their work through NFTs that carry royalties, copyright rights, or digital editions.

- Sports & Entertainment – Clubs and athletes can issue fan tokens or NFT-backed experiences, creating new revenue streams and fan engagement models.

- Infrastructure Fundraising – Governments and institutions can tokenize large projects (like stadiums or power plants) to attract transparent investment.

- Tokenized Investment Vehicles – Funds can tokenize traditional instruments,equity, royalties, or debt,to make them accessible to retail and institutional investors.

- Co-Ownership of High-Value Assets – Groups of investors can pool resources to jointly own luxury cars, farms, collectibles, or energy projects.

- AI & Metaverse Integration – Digital assets can be connected with immersive AI-driven or metaverse platforms, extending their utility beyond ownership.

- Community Financing – Diaspora groups, cooperatives, and grassroots communities can raise and manage shared capital transparently through blockchain.

- Secondary Market Liquidity – Token holders can trade assets instantly via the DEX, turning once-illiquid holdings into flexible investments.

- Secure OTC Options – For large or pre-listing trades, the OTC desk ensures regulated, partner-backed settlement.

Regulatory Standing & Compliance

One of Hashgreed’s strongest differentiators is its regulated status. The platform is licensed by Nigeria’s Securities & Exchange Commission (SEC) under registration RI 001/23. This is significant: most blockchain-based asset platforms in Africa operate in regulatory grey zones, making compliance a key risk.

By securing SEC oversight, Hashgreed positions itself as a trusted option for investors who would otherwise hesitate to engage in tokenized investments. The use of SPVs also ensures legal clarity around ownership and liability.

Adoption & Market Reach

Hashgreed has begun turning its vision into tangible projects on the ground. On its marketplace, the platform lists live investment opportunities such as GW Towers, a luxury mixed-use tower in Eko Atlantic City; FunCity FEC Alaro, a commercial and recreational hub in Alaro City; Vinekross Farms, large-scale agricultural ventures; and Insurance City, a proposed smart-city development along the Lekki–Epe corridor.

These listings illustrate the platform’s focus on both real estate and agriculture,two of Africa’s most enduring wealth-building sectors.

The company reports facilitating over ₦100 billion worth of tokenized transactions and attracting a community of more than 30,000 users, spanning retail participants and institutional stakeholders. While these figures are self-reported, they indicate the scale Hashgreed is targeting in a market where most asset-tokenization startups are still at the experimental stage.

What sets Hashgreed apart is the diversity of its adopters. Beyond individual investors, the platform works with property developers, real estate firms, and institutional partners to structure compliant offerings. Its inclusion in the Nigerian SEC’s Regulatory Incubation Program (cohort 001/2023) further strengthens its position, signaling to both investors and asset issuers that Hashgreed is building within the rules rather than around them.

Closing Analysis

Hashgreed is not building castles in the air. It’s building bridges between the world of traditional assets and the digital ownership economy. By focusing on tokenization of real-world assets,backed by regulation, SPVs, and transparency,it is delivering a practical use case for blockchain in Africa.

The platform’s strength lies in its clear value proposition: democratizing access to real estate and agriculture investments, sectors with deep cultural and financial resonance across Africa. Its regulatory compliance is a competitive moat, distinguishing it from many unregulated token projects.

Challenges remain: ensuring liquidity in secondary markets, maintaining investor trust, and scaling across borders. But if executed well, Hashgreed could become a model for how emerging markets tokenize real value and open opportunities to millions.