Africa’s cross-border payments landscape is evolving rapidly, and a new partnership between pan-African fintech NALA and global payments infrastructure provider Noah is drawing fresh attention to the role of stablecoins in solving long-standing settlement inefficiencies.

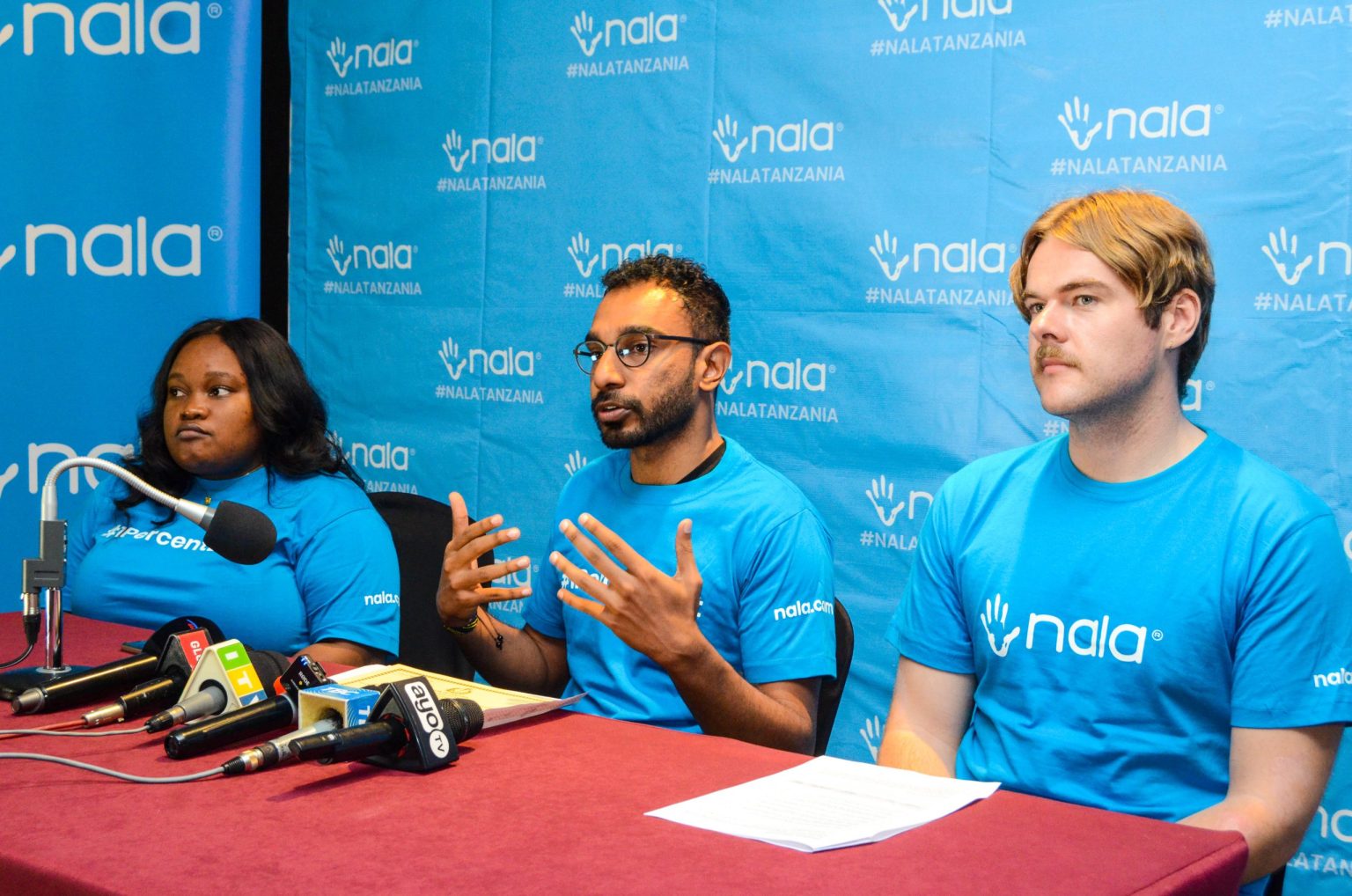

NALA, a fintech company founded in Tanzania that has grown into a major player across the continent and beyond, has partnered with Noah to launch an instant stablecoin settlement network, designed to facilitate swift and reliable cross-border transactions. This development marks a step toward addressing the delays, high fees, and operational complexity that have traditionally hindered payments into emerging markets.

The collaboration enables businesses to collect funds in U.S. dollars through Noah’s regulated virtual accounts, with payments converted into stablecoins in real-time. Once converted, NALA’s B2B payments platform, Rafiki, handles the routing and final settlement, enabling instant payouts into local bank accounts and mobile money wallets across Africa and parts of Asia. This structure removes the delays typically associated with correspondent banking while maintaining compliance at every stage of the transaction.

Combining Noah’s global dollar collection rails with NALA’s local payout infrastructure, the network enables near-instant settlement, operating independently of banking hours and reducing friction for businesses moving money across borders.

About NALA

NALA began as a consumer-focused money transfer service enabling users in the U.S., UK, and Europe to send funds to African countries such as Tanzania, Kenya, Uganda, and Ghana. Over time, the company expanded its footprint to 18+ countries, securing multiple regulatory licences and building deeper financial infrastructure.

In 2024, NALA launched Rafiki, a B2B payments API designed to serve global businesses, fintechs, and platforms that need reliable access to local African payment rails. This shift marked NALA’s transition from a remittance company into a broader payments infrastructure provider, supporting use cases such as payroll, merchant settlements, and enterprise disbursements.

The company’s expansion has been supported by a $40 million Series A funding round, which accelerated product development and international growth.

Why Stablecoins

Stablecoins play a central role in this settlement model because they enable fast, continuous, and predictable value transfer without the constraints of traditional correspondent banking. Pegged to assets like the U.S. dollar, stablecoins allow funds to move globally with minimal volatility while settling almost instantly once liquidity is available.

However, stablecoin adoption in real-world payments has often been limited by regulatory complexity and weak integration with fiat systems. The NALA–Noah partnership addresses this gap by embedding stablecoins within a fully compliant, regulated framework, linking dollar collection, on-chain settlement, and local currency payouts in a single flow.

Africa’s Stance Toward Infrastructure-First Payments

The partnership reflects a broader move within Africa’s fintech ecosystem: a move away from surface-level financial apps toward deep payments infrastructure. As cross-border trade, remote work, and global digital services expand, demand for faster, cheaper, and more reliable settlement rails continues to grow.

Rather than positioning blockchain as a speculative tool, NALA and Noah are applying it as a settlement infrastructure, focusing on operational efficiency, compliance, and real business use cases.

This approach aligns with a growing number of fintechs building stablecoin-based rails to address structural weaknesses in global payments, particularly in emerging markets where costs and delays remain high.

By embedding stablecoins into regulated payment flows, the network positions itself as a practical alternative to legacy systems, supporting businesses that require speed, transparency, and dependable liquidity across borders.

Read also: France Flags Nearly 90 Crypto Firms Ahead of EU Regulatory Deadline